Describe Which Is Greater Gross Pay or Net Pay

Gross pay is what the company tells you that they. Net pay Gross pay deductions.

Gross Vs Net Learn The Difference Between Gross Vs Net

Gross pay is the amount of money your employees receive before any taxes and deductions are taken out.

. Common pay frequencies include weekly biweekly semimonthly and monthly. Gross pay is almost always greater than net pay as net pay is after taxes benefits etc. When you get paid either by check or direct deposit youve probably noticed that your take-home pay is a lot less than the gross pay.

Gross pay is what the company tells you that they will pay you. While your gross pay is your combined income before any deductions your net income is your income after those deductions have been taken out. Gross pay is what the company tells you that they will pay you.

Net salary is the only physical amount that the employee enjoys and also known as a Take-home salary. The amount includes the agreed salary tips bonuses and other commissions that the person may accrue during the working period. First calculate your FICA taxes for the year otherwise known as your contribution to Social Security and Medicare.

Gross pay is payment before deductions. Gross pay is almost always greater than net pay as net pay is after taxes benefits etc. Therefore gross pay is greater than net pay.

It comprises of Net Salary Income Tax Retirals. Gross pay is the amount of pay BEFORE deductions have been subtracted. This is the actual amount that an individual takes home.

Similarly to the information you may learn in an accounting class gross minus expenses equals net. Net Salary can be equal to Gross Salary if the gross salary lies below the government tax slab limits. Net pay is the total amount of money.

Net pay can also be referred to as the take-home pay it is the amount of money the worker has to spend. This means that your gross pay is 2500 each paycheck. You will not get all of the fish in the total pond but will get a large sweep of them.

Net pay is the amount of pay an employee takes home AFTER deductions. Net pay is the amount of money your employees take home after all deductions have been taken out. Your gross pay is now 2375.

Your gross pay is the larger number indicated on your pay stub. Gross income is also the basis of your adjusted gross income or AGI which is needed to calculate your taxable income. Net pay is payment after deductions.

Gross pay is the great or grand pay the larger number. It is related to the concept of disposable income income after tax and. There are many deductions that can come out of your paycheck and they can include.

From this total pay which is known as gross pay the employer is required by law to withhold certain percentages of an employees paycheck to pay required tax withholdings. You can reduce the amount of your annual gross pay by this percentage before making other calculations. Gross salary is always greater than the net salary.

Gross pay is almost always greater than net pay as net pay is after taxes benefits etc. Gross pay is the sticker price that attracts employees to your business but net pay is what the employee receives and has to spend. After voluntary payroll deductions are subtracted and legally required payroll deductions are subtracted the pay that the employee receives is called net pay.

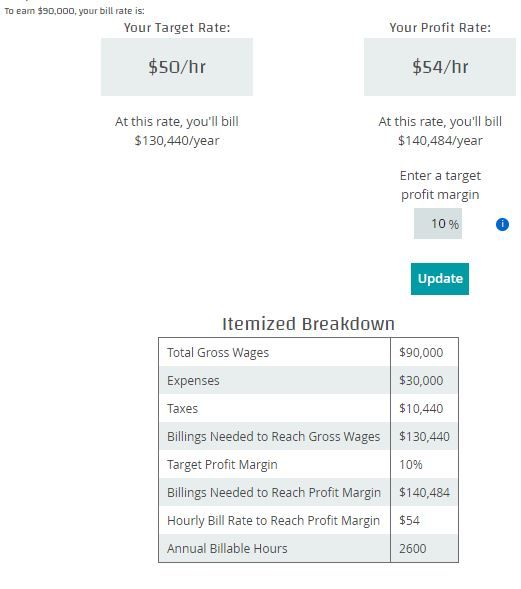

For example when you tell an employee Ill pay you 50000 a year it means you will pay them 50000 in gross wages. Taxes retirement contributions healthcare insurance life insurance pre-tax savings accounts such as HSAs and FSAs and. We at Everhour hope that this article was helpful in understanding the basics of calculating gross pay and net pay for.

Everyone pays a flat 765 rate on the first 128400 as of 2018 of earned income. If youre a salaried employee youll divide your annual salary by the number of paychecks you receive to determine your gross pay. You must determine an employees gross pay deductions and net wages each pay period.

Gross pay called gross wages or gross income is the salary or hourly rate an employer pays an employee. This will be the advertised salary such as 20000 a year. So as you can see while the calculations may seem intimidating the concepts of gross pay and net pay are actually very simple.

Gross pay reflects what the employee earns before deductions such as local state and. The best way to remember the difference between gross pay and net pay is that net pay is similar to a fishing net. Net pay is the amount of pay after deductions for tax and pensions.

Send You might be interested in. How to Calculate Net Pay. Gross pay is the total amount of pay received before any deductions.

Net pay is smaller than gross pay since tax and deductions have been subtracted from the gross pay to get net pay. Gross pay is a workers wages before deductions are taken out while net pay is a workers take-home pay after deductions are subtracted. Imagine your gross salary is 60000 and you get paid twice a month.

On the other hand net pay involves the amount that the person receives after all the legal and personal commitments have been deducted from the gross salary.

The Difference Between Net Pay And Gross Pay A Simple Guide Hourly Inc

Gross Vs Net Income Financial Infographic From Accc Learn More About Personal Finances To Better Manage Your Money Net Income Credit Card Debt Relief Income

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Vs Net Income Differences And How To Calculate Mbo Partners

Comments

Post a Comment